Coronavirus (COVID-19)

Tax Updates, CARES Act (Stimulus Relief), Business Resources, & FAQs

Due to the Coronavirus (COVID-19) pandemic, tax filing and payment deadlines have been extended, a stimulus package called the CARES Act is being enacted, loan assistance programs have been created, and many questions have been raised about our firm's availability and operations. We will update this page frequently with useful information about these topics. Please check back regularly.

Last Updated: 4/2/2020 12:13 PM

Tax Filing and Payment Updates

New tax deadline announcements.

Tax Filing FAQs

Common tax-related questions & answers.

Coronavirus Aid, Relief, and Economic Security (CARES) Act

Stimulus Relief Payments to Individuals

CARES Act checks: who's eligible?

Expanded Unemployment Insurance (UI) Benefits

Additional Provisions to Help Individuals

Additional CARES Act provisions for individuals.

Business Tax Relief Provisions

CARES Act business provisions.

Business Funding Options

Loans, Grants, and other financial assistance.

Tax Filing and payment Updates

Extended Deadlines

The IRS federal income tax filing due date is automatically extended from April 15, 2020, to July 15, 2020.

Taxpayers can also defer IRS federal income tax payments due on April 15, 2020, to July 15, 2020, without penalties and interest, regardless of the amount owed. This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax.

Taxpayers do not need to file any additional forms or call the IRS to qualify for this automatic federal tax filing and payment relief. Taxpayers who need additional time to file beyond the July 15 deadline, can request a filing extension (not payment extension).

State deadlines may differ from the IRS ones. For a complete list of every state's response to the COVID-19 pandemic, click here to view the AICPA's State Tax Filing Guidance.

Tax Filing FAQs

Does the deadline postponement apply to return filing and payments?

Do taxpayers need to file any additional forms to qualify for relief?

Has the filing deadline for all state returns been postponed to July 15?

Are first quarter 2020 estimated tax payments still due on April 15, 2020?

Have the second quarter 2020 estimated tax payments, due on June 15, 2020, also been postponed?

Does this relief provide more time to contribute money to an IRA, HSA, or Archer MSA for 2019?

I have tried calling the IRS for help, but I have been unable to reach anyone by telephone. What should I do?

How can I keep up with the IRS response to the Coronavirus and COVID-19 legislation?

Can I still file and pay my taxes now?

Is your office still open and are you still available to file my taxes?

Do I need to come into the office in order to have my taxes prepared by your firm?

How can I get my documents to you if your physical office locations are not open?

What is the turnaround time for having my taxes completed after submitting my documents?

Coronavirus Aid, Relief, and Economic Security (CARES) Act

Stimulus Relief Payments to Individuals

The Senate passed a stimulus package (the House has yet to vote but is expected to follow suit) which is being referred to as the CARES Act. A key feature of the Act is individual checks.

Checks are supposed to be produced “as rapidly as possible,” but it’s been suggested that could take up to two months. If you use direct deposit, it will be faster.

Checks will be $1,200 per adult – or $2,400 for married couples filing jointly – and an additional $500 per child.

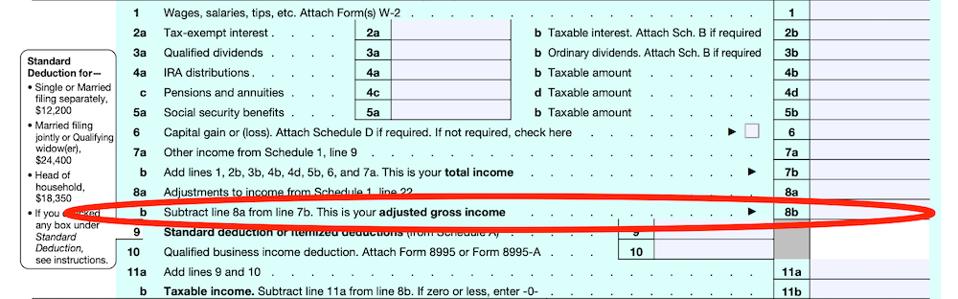

Phaseout means that the benefit goes down as income goes up. In this case, for every $100 of income above those thresholds, your check will drop by $5. So, if you are a single filer earning $75,100, your check will be $1,195 ($1,200-$5). If you are a single filer earning $85,000, your check will be $700 ($1,200-$500). If you do the quick math on that, it means that you’ll phaseout completely (meaning that you’ll get nothing) once you hit $99,000 as a single filer, $198,000 as a married couple filing jointly, or $146,500 for heads of household.

There are no limits on the number of children that qualify. The definition of child will be the same as for the Child Tax Credit.

Is my check taxable? No. This is not taxable income.

What if I’ve moved? Under the law, the Treasury must send notice of the payment by mail to your last known address. The notice will include how the payment was made and the amount of the payment. The notice will also include a phone number for the appropriate point of contact at the Internal Revenue Service (IRS) if you didn’t receive the payment. You can help make sure that it goes to the right place by updating your address after a move. Usually, you’d do that on your tax return, but you can also submit a federal form 8822, Change of Address (downloads as a PDF). It generally takes four to six weeks to process a change of address.

What about retired folks? Retired seniors are eligible.

What about those on government benefits? And those with no income? Yes, eligible folks include those with no income, as well as those whose income comes entirely from non-taxable means-tested benefit programs, such as SSI benefits.

Expanded Unemployment Insurance (UI) Benefits

The bill includes Expanded unemployment insurance (UI) for workers, including a $600 per week increase in benefits for up to four months and federal funding of UI benefits provided to those not usually eligible for UI, such as the self-employed, independent contractors, and those with limited work history. The federal government is incentivizing states to repeal any “waiting week” provisions that prevent unemployed workers from getting benefits as soon as they are laid off by fully funding the first week of UI for states that suspend such waiting periods. Additionally, the federal government will fund an additional 13 weeks of unemployment benefits through December 31, 2020 after workers have run out of state unemployment benefits.

Are self-employed individuals, such as gig workers, freelancers and independent contractors covered in the bill?

Yes, self-employed individuals would be newly eligible for unemployment benefits.

Benefit amounts would be calculated based on previous income, using a formula from the Disaster Unemployment Assistance program, according to a congressional aide.

Self-employed workers would also be eligible for the additional $600 weekly benefit provided by the federal government.

What if I’m a part-time worker who lost their job because of a coronavirus reason, but my state doesn’t cover part-time workers. Would I still be eligible?

Yes. Part-time workers would be eligible for benefits, but the benefit amount and how long benefits would last depend on your state. They would also be eligible for the additional $600 weekly benefit.

My employer shut down my workplace because of coronavirus. Would I be eligible?

Yes. If you are unemployed, partially unemployed or unable to work because your employer closed down, you would be covered under the bill.

Who would the bill leave out?

Workers who are able to work from home, and those receiving paid sick leave or paid family leave would not be covered. New entrants to the work force who cannot find jobs would also be ineligible.

How long would the payments last?

Many states already provide 26 weeks of benefits, though some states have trimmed that back while others provide a sliding scale tied to unemployment levels.

The bill would provide all eligible workers with an additional 13 weeks. So participants in states with 26 weeks would be eligible for a total of 39 weeks. The total amount cannot exceed 39 weeks, but it may be shorter in certain states.

The extra $600 payment would last for up to four months, covering weeks of unemployment ending July 31.

How long would the broader program last?

Expanded coverage would be available to workers who were newly eligible for unemployment benefits for weeks starting on Jan. 27, 2020 and through Dec. 31, 2020.

Additional Provisions to Help Individuals

Modification of limitations on charitable contributions during 2020. The provision increases the limitations on deductions for charitable contributions by individuals who itemize, as well as corporations. For individuals, the 50-percent of adjusted gross income limitation is suspended for 2020. For corporations, the 10-percent limitation is increased to 25 percent of taxable income. This provision also increases the limitation on deductions for contributions of food inventory from 15 percent to 25 percent.

Special rules for use of retirement funds. Consistent with previous disaster-related relief, this provision waives the 10-percent early withdrawal penalty for distributions up to $100,000 from qualified retirement accounts for coronavirus-related purposes. In addition, income attributable to such distributions would be subject to tax over three years, and the taxpayer may recontribute the funds to an eligible retirement plan within three years without regard to that year’s cap on contributions. Further, the provision provides flexibility for loans from certain retirement plans for coronavirus-related relief.

A coronavirus-related distribution is a distribution made to an individual: (1) who is diagnosed with COVID-19, (2) whose spouse or dependent is diagnosed with COVID-19, or (3) who experiences adverse financial consequences as a result of being quarantined, furloughed, laid off, having work hours reduced, being unable to work due to lack of child care due to COVID-19, closing or reducing hours of a business owned or operated by the individual due to COVID-19, or other factors as determined by the Treasury Secretary.

Allowance of partial above the line deduction for charitable contributions. The provision encourages Americans to contribute to churches and charitable organizations in 2020 by permitting them to deduct up to $300 of cash contributions, whether they itemize their deductions or not.

Student Loan Relief

- Payments Suspended: Federal student loan payments are suspended through September 30, 2020 and shall not accrue interest.

- Tax Relief: Students will not have to pay income tax on employer-made payments for education (which historically were taxed).

Reprieve from Negative Credit Reporting

- Who is Eligible: Borrowers who skip or defer a payment during the COVID-19 “covered period.”

- Note that this does not apply to payments or debts labeled delinquent prior to January 31, 2020.

- What Happens: Borrowers will be reported as “current” on their credit reports so their credit scores are not impacted negatively.

No Foreclosure or Foreclosure-Related Evictions

- Who is Eligible: Borrowers with federally-backed mortgages who claim they were “harmed by the coronavirus outbreak.” This includes “multi-family borrowers” as defined by the Act.

- What Happens: As of March 18, 2020, mortgage servicers cannot initiate foreclosure proceedings or implement foreclosure-related evictions during the “covered period.” Borrowers get up to 360 days of mortgage forbearance.

Business Tax Relief Provisions

There are a variety of business tax provisions:

- Employers are eligible for a 50 percent refundable payroll tax credit on wages paid up to $10,000 during the crisis. It would be available to employers whose businesses were disrupted due to virus-related shutdowns and firms experiencing a decrease in gross receipts of 50 percent or more when compared to the same quarter last year. The credit is available for employees retained but not currently working due to the crisis for firms with more than 100 employees, and for all employee wages for firms with 100 or fewer employees.

- Employer-side Social Security payroll tax payments may be delayed until January 1, 2021, with 50 percent owed on December 31, 2021 and the other half owed on December 31, 2022. The Social Security Trust Fund will be backfilled by general revenue in the interim period.

- Firms may take net operating losses (NOLs) earned in 2018, 2019, or 2020 and carry back those losses five years. The NOL limit of 80 percent of taxable income is also suspended, so firms may use NOLs they have to fully offset their taxable income. The bill also modifies loss limitations for non-corporate taxpayers, including rules governing excess farm losses, and makes a technical correction to the treatment of NOLs for the 2017 and 2018 tax years.

- Firms with tax credit carryforwards and previous alternative minimum tax (AMT) liability can claim larger refundable tax credits than they otherwise could.

- The net interest deduction limitation, which currently limits businesses’ ability to deduct interest paid on their tax returns to 30 percent of earnings before interest, tax, depreciation, and amortization (EBITDA), has been expanded to 50 percent of EBITDA for 2019 and 2020. This will help businesses increase liquidity if they have debt or must take on more debt during the crisis.

- Technical corrections to the depreciation treatment of qualified improvement property (QIP).

- The excise tax applied on alcohol used to produce hand sanitizer is temporarily suspended for tax year 2020.

- Aviation excise taxes are suspended until January 1, 2021. We estimate this will reduce federal revenue by about $8 billion in 2020.

Business Funding Programs

There are a variety of business funding options. Our firm is offering services to assist business owners with the application process and putting together the correct documents to quickly apply and get approved for several of these options. We will also help determine which options are most favorable based on your situation. Contact us for more information and to determine if we can assist you – (310) 800-1472.

Forgivable Loan for Up to 2.5 Months of Payroll (Paycheck Protection Program) (AVAILABLE TO APPLY NOW)

The bill allots $350 billion for special SBA loans that may be partially forgiven if certain conditions are met.Lenders will be authorized to make loans equal to 250% of an employer's average monthly payroll up to $10 million. Under that loan, eight weeks' worth of payroll obligations (including wages and benefits), plus rent or mortgage payments and utilities will be forgiven, and the amount forgiven would not be treated as taxable income to the small business owner.

The new loans will be available through 800 SBA-approved banks, credit unions and other lenders. But the bill also calls on the SBA and Treasury to increase the number of lenders offering the new loans. And it calls on the agencies to expedite the loan process.

- Who Can Apply: Small businesses and nonprofits with fewer than 500 employees

- Hospitality businesses (e.g., restaurants, bars, hotels, and RV parks) can treat each of their locations separately.

- If you have more than 500 employees, you may still qualify. Talk to your financial advisor.

- When You Can Apply: As soon as banks start processing the loans, which should be soon. Loans must be taken before June 30, 2020. Special provisions allow for “express loans” of up to $1MM, fast-tracking approval within 36 hours.

- How Much You Can Take: The loan amount is capped at the lesser of 2.5 times your average monthly payroll (based on the 1-year period before the loan date for most borrowers) or $10,000,000.

- How Loans are Forgiven: If you use the loan for “eligible expenses” during an 8-week period after your loan’s origination date, the amount up to the loan principal can be forgiven, tax-free. Eligible expenses include:

- Payroll costs, including salaries up to $100,000 (annualized) per employee, health insurance premiums, commissions, cash tips, and state and local payroll taxes – but not federal payroll taxes(1)

- Interest payments on mortgages for real or personal property (but not principal or pre-payments)(2)

- Rent(2)

- Utilities(2)

- Loan Forgiveness Is Reduced If:

- You reduce your full-time equivalents (FTEs), including cutting hours, during the “covered period.”

- You reduce the compensation of employees who make less than $100,000/year by more than 25% during the “covered period.”

- Those who also take the $10,000 Loan Advance described below will see the amount of their loan forgiveness reduced by $10,000

- However, you may avoid the reduction in forgiveness if:

- You made no further cuts by 30 days after the passage of the Act.

- You rehire and raise wages to prior levels by June 30, 2020.

- Repaying the Loan

- Your interest, principal, and fees will be deferred for 6 months to 1 year.

- The interest rate will be capped at 4%.

- The maximum loan maturity is 10 years from the date you apply for forgiveness.

- There are no prepayment penalties.

- Other Considerations:

- No collateral or personal guarantees are required.

- Sole proprietors, independent contractors, and self-employed individuals are all eligible under this program.

- If you already have an Economic Injury Disaster Loan (EIDL) through the Small Business Administration for COVID-19, you can refinance it into this program, but you cannot hold both loans for the same expenses.

_____________________________________

Economic Injury Disaster Loans through the SBA (AVAILABLE TO APPLY NOW)

The U.S. Small Business Administration is offering low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). Small business owners in all U.S. states and territories are currently eligible to apply.

- Who Can Apply:

- Business entities with 500 or fewer employees

- Sole proprietorships, with or without employees

- Independent contractors

- Cooperatives and employee-owned businesses

- Tribal small businesses

- Private nonprofits of any size

- When You Can Apply: Loan applications are available now. The application is combined with the $10,000 Loan Advance.

- How Much You Can Take: Up to $2 million.

- How Loans are Forgiven: Only the $10,000 Loan Advance does not need to be repaid (see next topic about this Loan Advance).

- Repaying the Loan

- Your interest, principal, and fees will be deferred for 6 months to 1 year.

- The interest rate will be 3.75% for businesses and 2.75% for nonprofits.

- Loan terms can be as long as 30 years.

$10,000 Loan Advance that May NOT need to be repaid (AVAILABLE TO APPLY NOW)

Small businesses may apply to receive an economic injury disaster loan advance of up to $10,000 that does not need to be paid back. The money would be paid out to business owners within three days of a successful application submission.

- Who Can Apply:

- Business entities with 500 or fewer employees

- Sole proprietorships, with or without employees

- Independent contractors

- Cooperatives and employee-owned businesses

- Tribal small businesses

- Private nonprofits of any size

- When You Can Apply: Loan applications are available now. The application is combined with the Economic Injury Disaster Loan.

- How Much You Can Take: Loan advance of up to $10,000

- How Loan Advance is Forgiven: The $10,000 loan advance does not need to be repaid. You may use the funds to:

- Keep employees on payroll

- Pay for sick leave

- Meet increased production costs caused by supply-chain disruptions

- Pay debts, rent, mortgage or other business obligations

Provides a hiatus on paying existing SBA loans (AVAILABLE NOW)

Business owners that already have an existing SBA loan will not have to pay interest or principal on it for six months.

Los Angeles City Small Business Emergency Microloan Program (AVAILABLE NOW)

The City of Los Angeles is offering emergency loans to businesses in the City of LA with 100 or fewer employees that have been negatively impacted by the COVID-19 outbreak and will make their best effort to continue or re-establish their business operations and employees. Business must have a Business Tax Registration Certificate with the City of Los Angeles' Office of Finance that was filed prior to March 01, 2020

Loan Limits

- $5,000 to $20,000

Interest Rate

- Option 1: 0% for a term of up to 18 months, with repayment deferred for up to 6 months

- Option 2: 3% for a term of up to 5 years, with repayment deferred for up to 12 months (for profit businesses)

- Option 3: 2% for a term of up to 5 years, with repayment deferred for up to 12 months (for tax-exempt businesses)

Local government relief funds and grants (MANY AVAILABLE NOW)

- Atlanta Business Continuity Loan Fund

- Berkeley Relief Fund

- Chicago Small Business Resiliency Loan Fund

- Connecticut, Greater Hartford COVID-19 Response Fund

- Denver Small Business Emergency Relief Fund

- Florida Small Business Emergency Bridge Loan Program

- Fort Collins Small Business Relief and Recovery Loan Fund

- Hillsboro COVID-19 Crisis Funding and Emergency Grant

- Kaimuki Small Business Relief Fund

- Kansas Hospitality Industry Relief Emergency Fund

- Long Beach Coronavirus Relief Fund

- Los Angeles Small Business Emergency Microloan Program

- Massachusetts Small Business Recovery Loan Fund

- Michigan Small Business Relief Program

- New Mexico COVID-19 Business Loan Guarantee Program

- New York City Employee Retention Grant Program

- Portland (Jade District and Old China Town) Small Business Response Fund

- Sacramento Small Business Emergency Economic Relief Loan Program

- Salt Lake City Emergency Loan Program

- San Diego Small Business Relief Fund

- San Francisco COVID-19 Small Business Resiliency Fund

- Seattle Foundation’s COVID-19 Response Fund

- Wisconsin Small Business 20/20 grants

Small business assistance options from other businesses

In addition to government assistance, companies like Amazon and Facebook have pledged to help businesses weather the pandemic and its fallout.

Amazon’s Neighborhood Small Business Relief Fund

Amazon’s Neighborhood Small Business Relief Fund pledges $5 million in assistance. Qualifying businesses have fewer than 50 employees or less than $7 million in annual revenue. And they must rely on foot traffic and be located within a few blocks of Amazon’s Regrade, South Lake Union, and Bellevue offices. To help distribute funds equitably, Amazon is asking applicants to anticipate expected losses associated with the coronavirus.

Facebook’s $100 million pledge

Facebook COO, Cheryl Sandberg, announced Facebook’s pledge of $100 million to small businesses impacted by the coronavirus. Facebook will distribute funds to 30,000 small businesses across the 30 countries where Facebook employees work.

Grubhub Community Relief Fund

Grubhub announced efforts to help small businesses in Chicago, New York City, San Francisco, Boston, and Portland. The Grubhub Community Relief Fund is collecting donations raised through their Donate the Change program. Officials in each of the five cities will help Grubhub identify organizations and small businesses that need help.

Other options to explore

Many companies, federal agencies, and private organizations offer grants for small businesses. Fundera has compiled a list of 107 small business and startup grants offered across the country. Each has its own eligibility criteria, and some include contests. Research each grant to determine if your business qualifies.

- James Beard Foundation Food and Beverage Industry Relief Fund

- Opportunity Fund Small Business Relief Fund

- Restaurant Workers’ Community Foundation COVID-19 Emergency Relief Fund

- MusiCares COVID-19 Relief Fund for entertainers and musicians

Schedule a Consultation

We are happy to answer additional questions. Mehdiani Financial Management is built on three core principles:

- Excellent customer service – Should you have a question or concern, our pledge is to address them clearly and patiently.

- We are dedicated to saving you money and providing you with the information you need to succeed.

- Keep more of your hard-earned dollars via tax planning, top-notch bookkeeping systems, and full-service assistance with all of your tax, compliance and organizational challenges.

Locations

Beverly Hills Office:

9025 Wilshire Blvd, Suite 301

Beverly Hills, CA 90211

Encino Office:

16030 Ventura Blvd, Suite 490

Encino, CA 91436

Phone: (310) 800-1472

eFax: (310) 496-2565

[…] (COVID-19) Funding Coronavirus (COVID-19) Resources 2020 Tax Season & Key […]